Countries Are Using Fossil Fuels To Cement Their Position As Cleantech Leaders

It is increasingly clear that countries that want to lead in both cleantech development and adoption will be the ones that support an all-of-the-above energy strategy for the next two decades

Success in both cleantech development and adoption appears increasingly tied to whether the country ensures they have cheap energy. This includes fossil fuels. Over the next two decades, we can expect a dichotomy between the countries that still embrace fossil fuels and use them to support cleantech leadership and the countries that take a less pragmatic view and see their cleantech progress stop and start. Let’s take a look at the early indications of this trend.

Emissions Decisions is a newsletter reviewing our thesis on environmental solutions and providing tools/insights to accelerate emissions reductions. Thank you for reading it!

Existing subscriber? You don’t need to do anything, but please share.

Was this forwarded to you? Become one of our subscribers by clicking below.

We need more fossil fuels in the near term.

The most crucial insight currently missing in energy transition discussions is that a ramp-up of fossil fuels will be required. The word “required” is used because it must be cheap for manufacturers and end users if you want wide cleantech adoption.

The energy transition is incredibly energy-intensive

First, we need to mine everything required for electrification. Countries continue to block domestic mining, so it shouldn’t surprise them that many of these required mines are in areas that don’t have reliable grids. This means these mining facilities can be expected to use a lot of diesel.

Once you’ve mined all the required metals, your cleantech manufacturing step requires cheap power and fuel. If it isn’t cheap, then the transition is inflationary (best case), or the companies cease to exist (worst case). Look at what’s happening in Germany below for this second case. We will come back to this again.

Households are highly resistant to inflation.

Once you’ve manufactured a solution, for example, electric vehicles, you then need rapid adoption by consumers, and this only occurs if it’s cheap (wasn’t expensive to make) and remains cheap (not expensive to operate). This requires cheap baseload power; no country has achieved this without nuclear, hydro, natural gas, or coal.

Nothing in the above should be shocking to people, and historically, it has been met with “Well, the energy transition will just be expensive.” That was easier for politicians to say before they saw that citizens have no desire to tolerate inflation. It ranks as the number one pain point for households (see below); almost every incumbent government has been voted out in the past twelve months in countries where inflation is the top concern. This means to remain in power and continue to guide cleantech policies, you can’t let it get expensive.

People will clearly not tolerate inflation, no matter what the reason. Cleantech adoption must, therefore, be low-cost (heavily supported by fossil fuels) for at least the next twenty years.

The countries that are cleantech leaders have built that lead using multiple cheap energy sources.

China has become the leader in solar manufacturing, produced the world’s cheapest electric vehicle, and at the same time has seen coal-fired generation hit a record high (someone please get them cheap gas). These things seem at odds, but they are related.

Many recent solar cost advancements, benefitting the entire world, have been made by China, which uses cheap coal. Using this approach, China has now reached a level where it is responsible for over 80% of the world’s capacity.

China has also produced electric vehicles that cost less than $10,000 due to cheaper manufacturing costs.

A car that is $10,000 with minimal moving parts (i.e., maintenance) can rapidly drive global adoption. Ironically, Canada, the US, and many other countries have tariffs on these cars, which kills adoption. For countries that say they are focused on the environment and cost of living, blocking a cheap EV is not aligned with those goals. It shows how many politicians would prefer to look good than make the complex tradeoffs required by the energy transition.

Prioritizing cheap energy ensures cleantech progress and adoption doesn’t stall

Cleantech milestones aren’t going backward. That low-cost Chinese EV will now drive adoption, reduce emissions, and create a watermark for other car manufacturers. The counter where cleantech companies start and disappear, partly due to high energy costs (see Germany) creates friction and confusion on the consumer side, which isn’t suitable for adoption.

Europe provides an excellent case study, where elevated energy prices now challenge domestic cleantech leadership. More than a third of industrial companies in Germany, including many industrial cleantech leaders, are cutting investments and citing power costs.

Germany hasn’t been focused on power costs and is paying the price. In contrast, Norway, the leader in electric vehicles, understands how crucial cheap energy is for adoption. This is why they’ve recently proposed scrapping their power links to other European countries - Norway doesn’t want to face expensive power domestically as a result of foolish decisions by their neighbors.

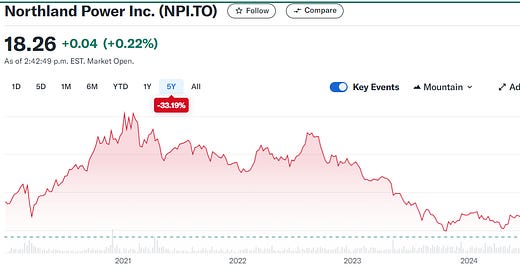

The final factor is that cheap energy means low rates, and the high-rate environment is challenging for renewables, given their long asset life. As an example, any renewable company stocks have hit 52-week lows during this higher rate period.

Any country that wants to encourage energy development will likely be a low-rate country, and the natural way to achieve this is with energy abundance. This becomes self-fulfilling, too, as energy over a long enough time horizon returns its cost of capital. An example of this is that free money in the early 2010s wasn’t that inflationary because a lot of it got sucked up by U.S. shale (reducing energy costs significantly at the same time). A LOW COST OF CAPITAL IS BAD FOR ENERGY SHAREHOLDERS AND GOOD FOR CONSUMERS (governments seem to think this is the opposite as they try to discourage access to capital).

The best opportunity for a country to significantly change its fortune and become a cleantech leader is by adopting a policy of energy abundance in the near term, or ALL OF THE ABOVE.

Happy holidays, and thanks for reading this year!

Impact Logic, a technical recruitment leader for impact-driven founders, sponsors our jobs section below. Reach out to them here as you look to fill critical roles.

Jobs that are worth looking at today include

Public Affairs and Logistics roles at Eavor

Engineering, Maintenance, and Advisor Roles at Capital Power

Engineering and HR roles with Carbon Upcycling

Marketing, Finance, Technical, and Engineering roles at Hydrostor

Engineering roles with Navier (you would be working on the below!)

Engineering and Sales roles at CarbonCure

Engineering, Finance, Ops, and Manufacturing roles at Crusoe

Was this forwarded to you? Become one of our subscribers by clicking below.

Thank you for your time and your thoughts!